Our blogging focus has been to analyze the office products industry while strongly emphasizing the aftermarket office supplies segment. Office products are a big, mature industry where the most prominent players exert significant control over the distribution channels and market shares. The future of office supplies dealerships faced with increasing competitive threats has become uncertain.

Our purpose in analyzing the market has been to identify compelling reasons why smaller, independent resellers may be motivated to open their minds to growth opportunities, invest in their businesses, and develop a positive outlook toward future growth and profits.

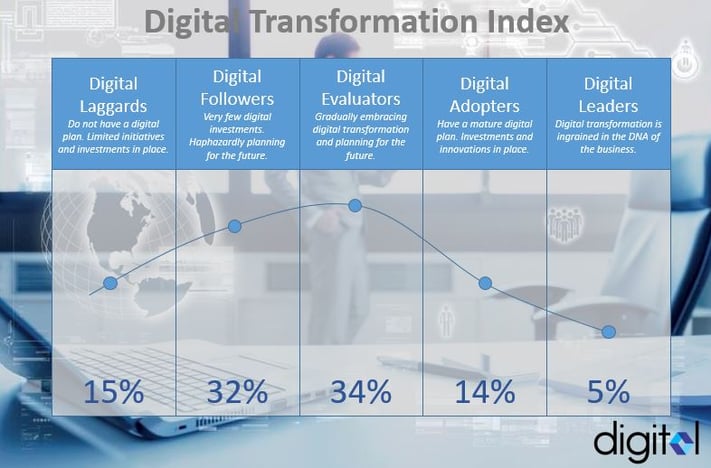

We have placed a significant emphasis on the role of the internet and the requirement for digital transformations. However, in assessing the elements required for a successful digital transformation, we're the first to recognize how difficult this is for a small business owner with limited time to research tactics and implement strategies to accomplish the goal.

We have concluded that an opportunity exists to disintermediate the big-box resellers, and smaller resellers who are up for the challenge may compete effectively in this market segment as opposed to the low-ball internet pricing market, such as found on Amazon and eBay.

We have concluded that an opportunity exists to disintermediate the big-box resellers, and smaller resellers who are up for the challenge may compete effectively in this market segment as opposed to the low-ball internet pricing market, such as found on Amazon and eBay.

Resellers shouldn't overlook that while the ink and toner market is tough. While it may now be declining at 1-2% per year, the annual market [as measured in retail dollars] is still estimated at $25 billion, the makeup of which is shown in the table below.

| Channel | Retail Dollars | Share | Avg. SP | Units |

| OEM | $20,000,000,000 | 80% | $100.00 | 200,000,000 |

| Tier-1 Aftermarket | $2,500,000,000 | 10% | $70.00 | 35,715,000 |

| Tier-2 Aftermarket | $1,250,000,000 | 5% | $50.00 | 25,000,000 |

| Internet (Amazon, eBay, etc.) | $1,250,000,000 | 5% | $20.00 | 62,500,000 |

| Total | $25,000,000,000 | 100% | $77.35 | 323,215,000 |

Imagine, for a moment, the $1.25 billion online market, represented by the Amazon and eBay marketplaces, is the "Red Ocean." The "Blue Ocean" comprises the $22.5 billion retail dollars of OEM brand and Tier -1 aftermarket cartridges sold through the big-box channels. The $1.25 billion represented by Tier-2 aftermarket forms the boundary between the red and blue oceans.

My point in explaining this and setting out the data in the table above is demonstrating the gulf between the "Blue Ocean" and the "Red Ocean."

Our assessment of the market leads us to conclude it's tough to build a profitable business in the Red Ocean, so if we're correct, the place to focus is the Blue Ocean, currently dominated by big box outlets such as Office Depot and Staples.

Look at the difference in the average selling prices—an OEM cartridge at $100 and an aftermarket cartridge through an online market at $20. Look at the boundary between the Blue and Red Oceans, where $1.25 billion is estimated to be transacted at an average selling price of $50.

Imagine independent office product resellers utilizing integrated information technology platforms and modern digital marketing tactics. Imagine targeting the $22.5 billion market, the 235 million units with an average retail price of $95, and forsaking the red ocean of 62 million units with an average retail price of $20!

Small business and sales channel development are not mutually exclusive terms. But, to thrive in our new internet-centric business environment, small businesses must adopt tactics that work in this modern digital age.

For the Blue Ocean channel development strategy to be seriously considered, the independent office products reseller must be convinced there's a future for its business and that an opportunity for profitable revenue growth still exists.

For this purpose, we authored our trilogy of books explicitly developed to help educate independent resellers on the market and the potential for revenue and profit growth, despite the challenging market conditions.

Book 1 - Office Products Resellers and The Path to a Business Transformation

Book 2 - Office Products Resellers and The $20 Billion Growth Opportunity

Book 3 - How the Aftermarket Industry Has Failed the Office Products Resellers

There

This experience has convinced us there's an opportunity for savvy digital marketers to grow their office product dealerships profitably. A significant market segment is vulnerable, and we've concluded the competition is poorly prepared for fast-moving, flexible, digitally qualified resellers.

However, we've also concluded it's difficult for smaller resellers to get to the level they need to be to successfully transform their business into the digital age.

So, to help overcome this problem, we're building a turnkey solution for establishing the foundation for office product resellers to start their journeys toward digital business transformations.