During this series of blogs, I've explained the aftermarket tipping point, explored scenarios for the OEM and aftermarket manufacturer merger endgames, the reseller merger endgame, the consumer product adoption curve as it relates to aftermarket ink and toner, and the possibilities for aftermarket share development. In this concluding post of the series, I will summarize the key points and identify what it will take for Tier-2 and three resellers to make a difference.

The Aftermarket, Office Supplies, and a Major Tipping Point

The OEM Mergers Endgame (Part II)

The Aftermarket Manufacturer's Mergers Endgame (Part III)

The Reseller's Mergers Endgame (Part IV)

Summary - The Mergers Endgame (Part V)

The Consumer Product Adoption Stages (Part VI)

The Battlegrounds for Market Share (Part VII)

I've explained how the OEMs have effectively orchestrated a cartel (triggered after the early shock of losing 20% of the monochrome market to the remanufacturers during the 1990s) for the dual purpose of maintaining their pricing model and for preventing the aftermarket resellers and manufacturers from capturing market share.

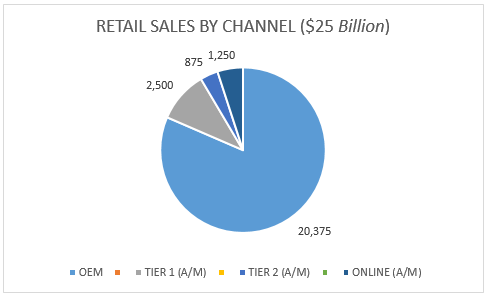

I've introduced the concept that the recently emerged Chinese aftermarket manufacturing superpowers have sufficient financial power to orchestrate their strategies that may break the cartel and, if successful, that the share of the $25 billion U.S. market for ink and toner may finally be on the point of moving in favor of the aftermarket.

I've presented my views on the OEM, aftermarket, and resellers merger endgames and explained it's unlikely these events will impact the share between OEM and aftermarket products. If anything, the OEMs will become even more potent in the absence of the Chinese aftermarket manufacturing superpowers as their global mergers endgame plays out.

I've explained it's not very likely there will be a significant shift in market shares without the Tier-2 & 3 resellers and distributors stepping up to develop it because the only way to build aftermarket share is to break the cartel. The only way to break the cartel is to go around it.

The Tier-1 Chinese aftermarket manufacturers have the products, the legal foundation, and the cost structure to support significant growth in market share. Perhaps anticipating this eventual outcome, a group of second-tier office product and supplies distributors has already emerged to serve the North American markets. These distributors have the necessary expertise for importing Chinese products and the infrastructure to support fast, cost-effective deliveries to the customers of the Tier-2 & 3 resellers.

So, we already have the manufacturers, the products, and the distributors in place. We're missing the resellers necessary to get the products into the hands of the consumers.

As we know, the required resellers exist; over the last few years, they've been jumping into the "Red Ocean" of predatory internet pricing, trying to win random customers looking for the lowest prices. To do this, they've adopted low-cost Chinese products because, without them, they couldn't enter the Red Ocean in the first place. However, the problem is even with the low-cost Chinese products; there's no way for the resellers to make any money. It's a pricing death spiral, there's no profit to fund the development of loyal customers, and there's no infrastructure or strategy for entering the "Blue Ocean" dominated by the Big-Box and Tier-1 resellers.

Remember, it's a $25 billion annual market, and 90% of these retail dollars are currently spent through the Tier-1 channels. These are mostly a mix of Blue Ocean $100 OEM cartridges and Tier-1 $70 aftermarket cartridges, not Red Ocean $10 internet cartridges!

This is it in a nutshell. For the aftermarket to increase its market share, it must take place with Chinese, patent-safe, new-build cartridges imported by the Tier-2 distributors and sold into the Blue Ocean customer base by the Tier-2 & 3 resellers.

This is it in a nutshell. For the aftermarket to increase its market share, it must take place with Chinese, patent-safe, new-build cartridges imported by the Tier-2 distributors and sold into the Blue Ocean customer base by the Tier-2 & 3 resellers.

Bottom line, any success for the newly emerged Chinese manufacturing superpowers in terms of increased market share in the North American markets comes down to the ability of the Tier-2 & 3 resellers to step up their game and to develop sufficient capabilities to compete effectively in the Blue Ocean customer base currently paying for OEM and Tier-1 aftermarket cartridges.

If this is the case, what will it take to achieve the desired outcome?

Time - there's no overnight solution. Any reseller who may think there's a quick, simple solution is flat-out wrong and needs to reevaluate or get out of the business. Start thinking of a one-year effort to set the foundation and then 2-4 years to successfully develop a growing and profitable business.

Hard work - if anyone thinks there's a "stay-at-home," "feet-on-the-table," or "build-it-and-they-will-come" solution, then they also may be better off closing up shop now and moving on to something different. There is no alternative to achieving a successful outcome besides combining hard work with modern digital business solutions and business intelligence.

Face-to-face relationships in local markets - this is the key. Despite all the fuss about social media, digital marketing, e-commerce, and the internet, customers in the Blue Ocean like to buy from businesses they know and companies they trust. This means getting out of the office, getting in front of customers and prospects, and developing the necessary relationships.

Information Technology - implementing and using information technology is not a "nice-to-have" - it's a fundamental requirement. It can't be put off if a reseller wants to compete in the Blue Ocean.

Digital Expertise (website and social media) - like it or not, social media is here to stay and is where all the marketing dollars flow. It's not easy, and it's not a silver bullet. If you don't know what you're doing, it's likely to be a waste of time. However, if you want to survive in the digital era, an effective social media strategy is a requirement, not an option. Furthermore, deploying a social media strategy without a modern, content-rich website will likely waste time and money.

Marketing (leveraging social media and email marketing) - so, even if you have all your social media accounts setup and a decent content-rich website deployed, then if you don't know how to use them to conduct an effective inbound digital marketing strategy, the investments to establish these capabilities will most likely turn out to be a waste of time and money.

Conclusion:

Suppose the Tier-2 & 3 resellers fail to show an interest in the substantial growth opportunity that still exists, despite the mature and slowly declining overall market. In that case, the cartel will stay in place, and the aftermarket players will be destined to play a part in the OEMs and Tier-1 resellers.

The problem is that time is running out for many of the weaker Tier-2 & 3 resellers. The success of the OEM blocking tactics over the last 15 - 20 years has significantly weakened the channel. Not only are financial resources limited, but perhaps more crucially, the energy necessary to commit the required human resources, along with the will of the independent reseller to survive, have also both been compromised.

So, with my ongoing analysis, observations of the market, and knowledge of the remaining players and their likely tactics, I have concluded that to achieve the desired outcome of increased aftermarket share, there must be an injection of energy alongside the deployment of a transformational digital solution. The Tier-2 & 3 resellers must be able to take this solution to the market and successfully win profitable business in the Blue Ocean customer environment.

Without this, I believe the aftermarket presence will, at best, stagnate over the longer term, although more likely to decline. Should this be the case, then the OEM strategies will prevail, and most consumers will continue to pay extraordinarily high prices for their ink and toner cartridges.