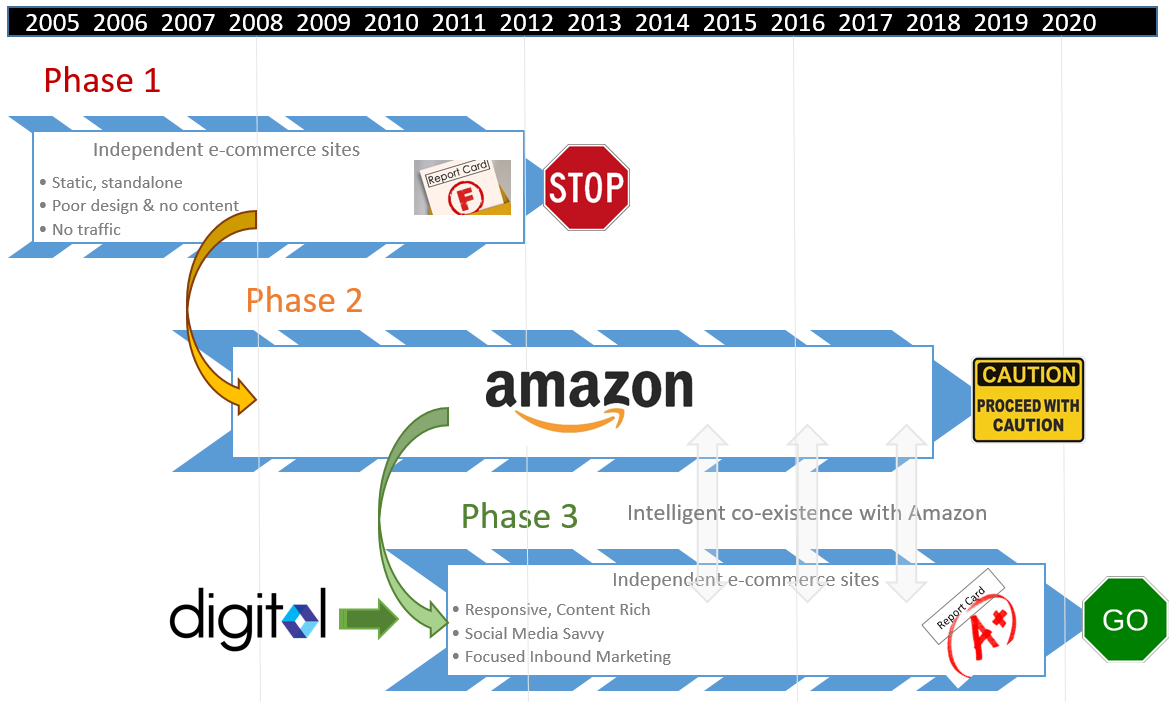

Is the Amazon Marketplace a healthy business environment for resellers or not? This is an important question that needs to be addressed and better understood by all merchants, not just those involved in the office products and supplies vertical. The last 10+ years have seen countless failures by resellers as they've put up shopping cart sites to try their hand at online commerce. A lot of time and money has been wasted with efforts that, for the most part, never stood a chance to succeed. Of course, the online environment is dynamic, and what's required to be successful today is quite different from what was required ten or more years ago. Nevertheless, efforts to develop an online presence by continuing to throw up shopping cart sites without a determined and sophisticated traffic development strategy are naive and destined to fail.

It's perhaps unsurprising, and perhaps primarily due to these failures, that, over the last few years, resellers have been abandoning their independent online efforts and entering the Amazon Marketplace. On the face of it, the logic is quite sound. Amazon is by far the largest e-commerce portal in terms of transaction dollars and site traffic with 95 million unique monthly visitors; if a reseller can't get traffic to its site, then why not join a marketplace that already has traffic and conduct its online commerce there?

However, although the Marketplace is there for anyone to participate in an attempt to take advantage of, there are formidable barriers to overcome to conduct profitable transactions. Unlike any other business venture, there needs to be research and a plan, followed by setup and execution.

Within the Marketplace, it must be remembered that Amazon's objective is to drive sales, regardless of which Seller the product comes from, so they will always point shoppers to the products that are most likely to sell. Of course, the products that are most likely to sell appear in search results, and the two most influential factors in determining a product's search ranking are its sales performance history and relevance.

Sales Performance History

The Marketplace is an intensely competitive environment, and although having the lowest price does not guarantee sales, it plays a leading role. It's logical to conclude that competitive pricing is essential for conducting sales and establishing a sales history. Unfortunately, for a new or recent merchant on the platform with little to no sales history, ranking well in search results is difficult.

Relevance

A seller can influence search results by optimizing product content setup and improving its relevance for search terms. However, (unless you own and register your brand in the Amazon Brand Registry) there's also a dilemma with this approach.

Investing resources to provide the best description and features for a product detail page while not owning the Buy Box means a reseller is implementing conversion rate optimization (CRO) best practices for all of its competition. As I've explained, Amazon's objective is to convert the maximum number of searches into sales, so if they see better descriptive elements for a product, they will select those elements (or pieces of them) regardless of whether or not it's for the Seller's product. In other words, the product content assets developed by a diligent seller become a shared resource in the Marketplace that may help lower-priced, less active competitors to become more successful.

For this reason, efforts to optimize product setup must be invested into products where ownership of the Buy Box is high or for products that may be exclusive to the Seller.

| ASIN | Amazon Standard Identification Numbers are unique blocks of 10 letters and numbers. A new ASIN is created when a new product is uploaded to the Amazon catalog and can be found on the product detail page. |

| Amazon Brand Registry | Brands that are part of the AMZ Brand Registry have higher authority over their product listing content as the listing content is no longer shared. Products associated with an approved brand are assigned a GCID, not an ASIN. |

| Buy Box | The product detail page is where the battle for the Buy Box ownership takes place. Over 80% of sales are determined from the Buy Box. |

| Buy Box Eligibility | Professional sellers who have met performance requirements become eligible to compete for the Buy Box and, when unsuccessful, to compete for the "More Buying Choices" box. |

| Buy Box Ownership Share | Winning the Buy Box is a significant advantage for sellers on Amazon. It's an ongoing process as sellers earn a share of the Buy Box or rent it for some time. 80%+ of Amazon's e-commerce sales result from the Buy Box. |

| Buyability (B) | They are converting shoppers once they land on a product page. Explains why an overall AMZ strategy should be focused around Buyability, which, in turn, is strongly influenced by the quality of the content provided by the Seller. |

| Category-Specific Data Attributes | Optional fields to populate to provide more information about the product - influences Discoverability via filters and Buyability via conversion rate optimization (CRO) by maximizing the number of product details on a page. |

| Conversion Rate Optimization (CRO) | Optimize the content on product detail pages to match popular searches conducted by potential shoppers. |

| Description | Heavily weighted in SERP - maximum of 2,000 characters per description. |

| Discoverability (D) | The ability for a product to be found - driving shoppers to product pages |

| Featured Merchant | Preliminary status is required to become eligible for the Buy Box. In most cases, a rating greater than 98% will obtain the Featured Merchant status. |

| Fulfill By Amazon (FBA) | Seller ships product to Amazon warehouse - Amazon handles storage, packaging, shipping & customer service. Products are eligible for Prime (V. important because 20 million members instinctively filter by Prime). Through improved Discoverability and durability, Amazon ensures a strong correlation between FBA and higher sales performance. |

| Fulfill By Merchant (FBM) | The seller is responsible for storage, shipping & customer service. The pricing strategy should be to include shipping & handling. It's far less likely for an FBM seller to win the "buy box" over an FBA seller. |

| Fulfillment Method | Influences both Discoverability & Buyability - i.e., FBA improves both! |

| Fulfillment Latency | The length of time it takes you to ship after receiving an order. The lower the latency, the better prospects for appearing in the Buy Box. |

| GCID | Global Catalog Identifier differs from the ASIN in that it's linked directly to a product and will never change, whereas an ASIN is tied to a product listing and can change. The GCID is a 16-character alphanumeric code. |

| Images | High quality, zoomable - one central image and up to eight seconds. |

| Inventory Depth | Sellers with consistent and sufficient inventory to avoid stock-outs can be granted a higher Buy Box share. |

| Inventory Quantity | Merchants will quickly drop the Search Engine Results Performance (SERP) if they have no inventory. |

| Keywords | AMZ is unique, allowing sellers to provide a list of keywords. It used to be a max of 5 fields x 50 chs. = 250 chs. Total. Feb 2016 changed to 1 area x 1,000 chs. |

| Landed Price | List price plus shipping & handling. Landed price is regarded as one of the most influential Buy Box factors and is within the complete control of the Seller. |

| Listed Price | The price set by the Seller excluding freight & handling |

| Manufacturer Part # | Shoppers will search by OEM Part # |

| Price Optimization | It is a myth that the lowest price ensures winning the Buy Box. Optimizing costs will increase the chances of winning the Buy Box and increase profits. |

| Product Ads (Sponsored Links) | Allows retailers to advertise on the Amazon marketplace without having to sell on the Marketplace itself. See also Sponsored Links. |

| Product Content | The single most significant factor in increasing listing relevancy (for a given search) is a vast Discoverability driver. |

| Product Detail Pages | It can only be created for unique products and must not be made for products that already exist in the AMZ catalog. |

| Product Features | Up to 5 fields can be populated and each should include information that may favorably influence a sale. Features should be built in a consistent order - i.e., if the first feature is country or origin, then ensure it is so for all products. |

| Product Reviews | Drives Discoverability via search filters - i.e., the shopper applies a search filter to eliminate products (for example) with less than three stars. |

| Product Title | The most heavily weighted aspect of product content is 250 - 500 characters depending on the product loathe d method (CSV or XML). |

| Relationship between (B) & (D) | By increasing sales (Buyability), the product rises higher in search results and thus increases Discoverability, thereby driving a virtuous cycle. |

| Reseller Strategy | When to focus resources on Discoverability Vs. Buyability and vice versa. |

| Seller Feedback | Influences Buy Box ownership share less than the Seller Rating does, but still significant. There are two components; the Seller Feedback Score and the Seller Feedback Volume. |

| Seller Fulfilled Prime (SFP) | Allows FBM sellers to reach Amazon Prime Members without being forced to stock products in the Amazon DCs. |

| Seller Rating | One of the top Buy Box factors is an overall assessment of how well inventory management, order management, fulfillment, and customer service are handled. |

| Sponsored Links | Sponsored Links are advertisements related to a recent product search query or content on the page and are always clearly labeled. Clicking on a link will take the user from the Amazon Marketplace to a 3rd Party site. |

| Sponsored Products | Amazon's inter-Marketplace pay-per-click program. Only sellers eligible for the Buy Box and selling in the available product categories are qualified for Sponsored Products & Targeted Ads. |

| UPC | A Universal Product Code is a 12-digit bar code used extensively for retail packaging in the United States. To load a product to the Marketplace, you must have a UPC. |

Owning the Buy Box

For a seller with little to no sales history, it may seem there's no possibility of owning the Buy Box. However, one strategy for overcoming this dilemma could be structured around the following approach:

- The reseller creates a brand

- Registers and receives approval for the brand at the Amazon Brand Registry

- Create unique product ID codes and product details for each product

- Loads the products to the Amazon catalog creating a set of unique identifiers called GCIDs

Because a unique product has been created and, even though it has no sales history or Discoverability, the merchant will own the Buy Box for that product. Next, by utilizing the Sponsored Product program, the Seller can pay for increased Discoverability. A strategy like this can be an effective acceleration tool for enhancing product discoverability and developing sales. However, the costs to promote the brand and its associated products in the Marketplace will likely be relatively high and possibly beyond the means of a small merchant. Also, somewhat complicating this approach, it must be remembered that eligibility to win the Buy Box is not available until a seller has achieved "Featured Merchant" status.

Without the increased discoverability made possible by a Sponsored Product strategy, there will be little to no brand awareness, low discoverability and, little to no sales.

Who owns the customers?

Whether selling FBA or FBM, Amazon handles the credit card transaction with the customer and, after deducting its fees, sends the balance of the funds to the Seller. Because Amazon deals directly with the customer, it's tough for the Seller to build a direct customer relationship. Furthermore, it's Amazon's platform; they set the rules, they may change them at any time, and they can adjust them to favor certain sellers who may have sufficient volume to influence them.

Remember, it's Amazon's objective to drive sales regardless of which Seller the product comes from. A repeat customer has little incentive or motivation to seek out the previous Seller. Instead, whatever Seller appears in the Buy Box will heavily influence the customer. For a commoditized product (like ink and toner), and with many sellers active in the Marketplace, the chances of the same Seller appearing in the Buy Box three to four months after a prior transaction are remote. The point here is that the Seller and the customer have little to no loyalty. Instead, the belief is between Amazon and the customer, so it should be clear that Amazon owns the customer, not the Seller.

What if Amazon decides to sell direct and compete with its merchants?

When Amazon decides to enter a category, they purchase the product they need from a vendor. They are prepared to price the class to achieve their market share objectives, and as they do not agree to any Minimum Advertised Pricing (MAP) rules, there's a danger to both the FBA and FBM merchants that Amazon may undercut them to achieve their market share goals.

When Amazon decides to enter a category, they purchase the product they need from a vendor. They are prepared to price the class to achieve their market share objectives, and as they do not agree to any Minimum Advertised Pricing (MAP) rules, there's a danger to both the FBA and FBM merchants that Amazon may undercut them to achieve their market share goals.

Amazon has remarkable power and almost certainly has;

- The potential to be able to price lower than existing Buy Box prices.

- The ability to award itself a perfect score on the service elements necessary for winning the Buy Box.

- Perfect knowledge of the platform rules for Buy Box placement.

- The ability to adjust their sell price to any level.

For these reasons, Amazon can effectively guarantee it will win the Buy Box when it chooses to do so, and can achieve this result using exactly the same Buy Box placement algorithm as is applied for all the Marketplace merchants.

What's the outlook for pricing when Amazon is competing with its merchants?

No one understands the rules of the Marketplace better than Amazon itself. Of course (you would think), they want to maximize their sales and profits, so we shouldn't assume they'll automatically engage in predatory pricing strategies because this may compromise their profit objectives. However, the critical point is that Amazon likely has short and long-term goals. In the short term, they may b,e more motivated by market share than profit; in th; inerm, they may be more motivated by profits.

The Amazon platform provides the clear potential to buy market share in the short term, eliminate competition, and then to increase prices to maximize profits.

Let's explore an example using the data in the table below:

| FBM | FBA | Amazon_1 | Amazon_2 | |

| Vendor List Price | $120 | $120 | $120 | $120 |

| Amazon Buy Box Price | $100 | $100 | $100 | $95 |

| Average Merchant Cost | $75 | $80 | $70 | $70 |

| Vendor Promo (15% off list) | $0 | $0 | $18 | $18 |

| Net Cost | $75 | $80 | $52 | $52 |

| Amazon Commission | $20 | $15 | $0 | $0 |

| Merchant Gross Margin | $5 | $5 | $48 | $43 |

| Gross Margin % | 5% | 5% | 69% | 61% |

Vendor Promos

Amazon periodically approaches its vendors to participate in promos which are incentivized with a commitment to increased sales volume in return for an agreement to a discount off the list price. So, for example, a 15% promo may result in a "commit" from Amazon to sell 100 units over a specific timeframe. If the vendor accepts, Amazon immediately places the purchase order and takes the promo dollars (in our example, $18 x 100 = $1,800), regardless of whether or not they subsequently sell the target volume within the targeted timeframe. Note also, in this example, a 15% discount off the list price is, in fact, a 25% discount on the original negotiated sell price of $70 per unit!

The Buy Box

With the promo dollars, Amazon is equipped to engage in pricing that effectively guarantees they will own the Buy Box at the expense of its merchants in the Marketplace. When they target the Buy Box (for example) at $95, then many of the merchants may "chase" the price down to that level (eliminating all their gross margin on the way). At the same time, Amazon's keg remains full of powder to take the pricing as low as may be necessary for it to continue to own the Buy Box.

In this scenario, the merchants that brought the category and the customers to the Amazon platform will gradually be eliminated, leaving Amazon controlling a larger market share. Inevitably, as competition is reduced, prices will start to increase.

Let's not forget the resellers I'm talking about are mostly the more diminutive guys who have effectively gone to Amazon as their last resort for sales growth. Their independent e-commerce efforts have failed, their efforts to take share from the OEMs have mostly failed, and their efforts to take share from the Big Box retailers (selling OEM and premium-priced aftermarket cartridges) have also failed. Now, as they're eliminated from the Amazon platform, there's nowhere to go. It's not like they can exit the Marketplace, wait on the sidelines for a few months while prices increase, and then step back in. It's simply too late for this option as they're confronted with the final step in their business cycle and forced to exit permanently.

Conclusions

Everyone's drawn to Amazon because of the prospect of selling large volumes. But, to stand any chance of trading book, not only does the Seller have to incur a significant time and resource investment for setting up the products and for learning how to sell on the platform, but it must also have deep pockets to finance winning the Buy Box over a sustained period in order for its relevancy, and then its volume on the platform, to be developed.

Unfortunately, as we've shown in our example, due to the structure and nature of the Marketplace, success can lead to punishment. If a seller (or group of sellers in a specific vertical such as office supplies) is successful, Amazon notices and enters the category to compete directly. Because of the volume incentives, they're able to offer vendors, they can guarantee themselves control of the Buy Box from which over 80% of transactions in the Marketplace occur.

Not only does Amazon control the Buy Box, but they also know every single customer that's ever purchased through their platform. Remember, it's unlikely a merchant selling in the Marketplace will experience repeat orders from the same customer and, consequently, doesn't know the frequency of a consumer's demand. This, however, is not the case for Amazon. A customer buys the same item every three months from four different merchants, while each merchant has no idea of the three-month buying pattern, Amazon knows. So, when the subsequent customer demand is anticipated (for example, month fifteen), who do you think maybe poised with a vendor-financed promo to win the business?

The Marketplace is not for the faint-hearted, and it's certainly not a silver bullet solution. In the short term, it's expensive to get started, and in the long time, it's somewhere between difficult and impossible to establish a business that adds value to a resellers enterprise.

A future buyer of a resellers business may be inclined to discount any revenue and profits earned in the Marketplace because he knows Amazon can change the rules and take that business away at any time.

Sellers must treat the Marketplace dispassionately and objectively. Amazon may try and make its merchants think they're its partner, but it's not, it's their competitor, and it will always treat them as a means to achieve its end, not theirs. Once this cold, hard reality is understood and recognized, merchants must adopt a similar stance by implementing strategies that allow them to treat Amazon as a means to achieve their end.

We'll publish additional material in the coming weeks related explicitly to tactics that may allow resellers to leverage the benefits of the Marketplace in the short term while implementing strategies for growth in their local markets in the medium to long term. Systems where, most importantly of all, they will own the hard-earned relationships with their customers and their prospects in their markets.

We'll publish additional material in the coming weeks related explicitly to tactics that may allow resellers to leverage the benefits of the Marketplace in the short term while implementing strategies for growth in their local markets in the medium to long term. Systems where, most importantly of all, they will own the hard-earned relationships with their customers and their prospects in their markets.